Fintech & Banking in the Age of AI: What the Future Demands from Entrepreneurs, Employees, and the Next Generation

The financial industry is undergoing a massive shift. As artificial intelligence, blockchain, and real-time data systems become mainstream, the future of fintech and banking is being rewritten—fast. For current professionals, entrepreneurs, and tomorrow’s workforce, this transformation opens up both challenges and opportunities.

This article lays out what’s changing, why it matters, and how different groups—from startup founders to young professionals—can adapt and thrive.

What’s Driving the Change?

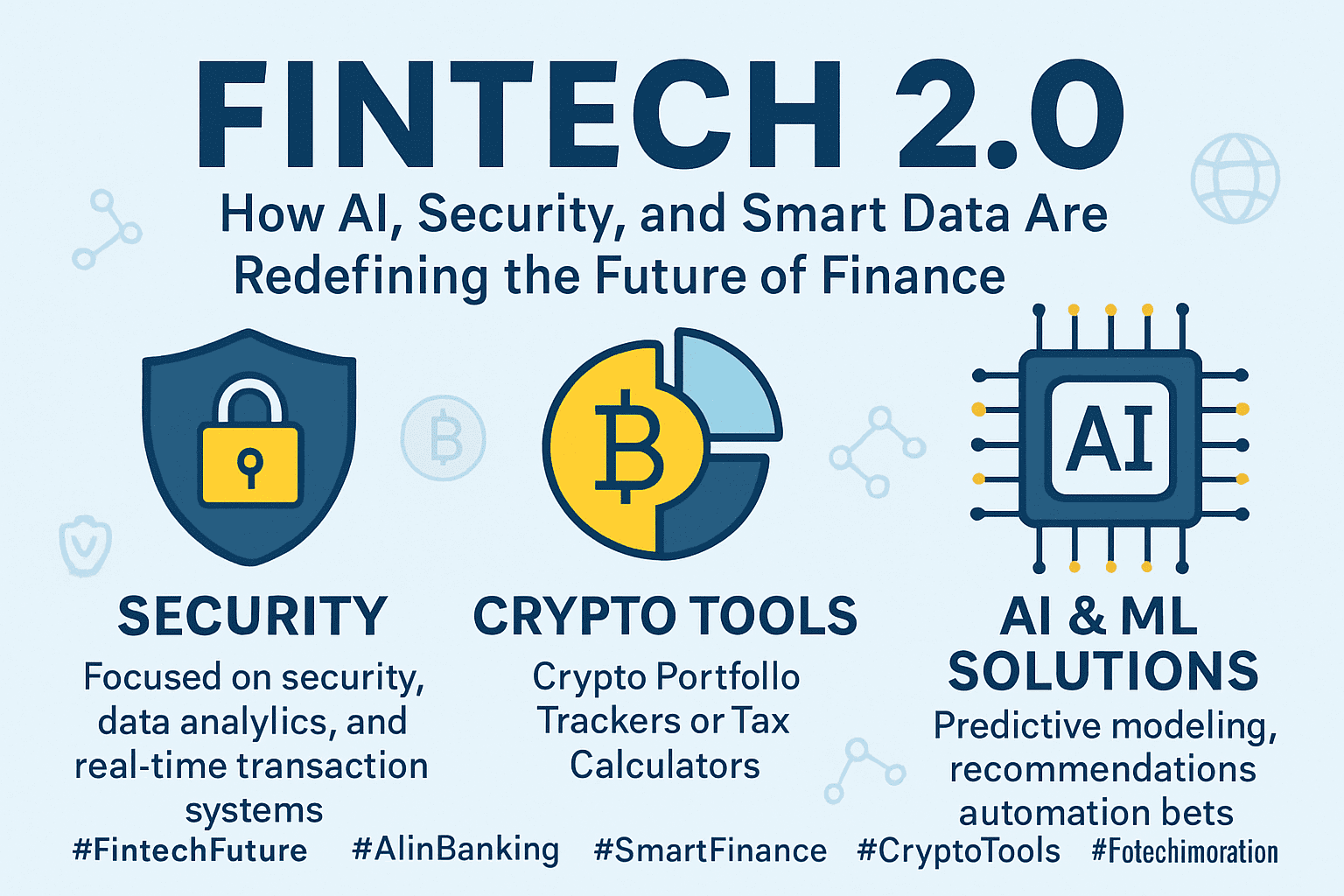

Three major forces are reshaping fintech and banking:

- Security First In a world of increasing cyberattacks and fraud, financial platforms must prioritize ironclad security. Regulatory pressure and consumer expectations have made data protection a core feature—not a luxury.

- Data as Currency Fintech thrives on data. Every transaction, login, and user behavior offers insight. Real-time analytics allow platforms to personalize experiences, detect fraud instantly, and make smarter lending or investment decisions.

- AI-Powered Real-Time Systems: Customers want speed. Whether it’s sending money, tracking a crypto portfolio, or receiving personalized financial advice, instant response has become the standard. AI enables systems to analyze and act on large volumes of data in milliseconds.

Emerging Tools: Crypto Trackers & Tax Automation

The rise of blockchain and crypto has brought new demands—and new solutions:

- Crypto Portfolio Trackers offer unified dashboards that consolidate wallets, track DeFi assets, and notify users of market changes in real-time.

- Crypto Tax Calculators automate the complex process of calculating gains, losses, and taxable events—making compliance simpler for everyone from casual investors to institutional traders.

Both tools reflect a broader trend: people want to understand and manage their finances without hiring an army of accountants or analysts. Smart automation, driven by AI, is making this possible.

Where AI & Machine Learning Take Over

AI is no longer just a backend feature—it’s a core differentiator. Here’s how it’s being used:

- Predictive Modeling helps institutions anticipate loan defaults, detect fraud patterns, or forecast investment risks.

- Recommendation Systems personalize the user experience—suggesting savings plans, financial products, or optimized credit offers based on behavioral data.

- Automation Bots replace repetitive tasks like customer service inquiries or onboarding, freeing up human workers to focus on high-impact decisions.

What It Means for Different Audiences

For Entrepreneurs

If you’re building in fintech, your product must combine security, speed, and intelligence. AI/ML isn’t a bonus—it’s the backbone. Whether you’re developing a crypto tool, a payment app, or a neobank, the bar is higher now. Build trust, prove security, and use data ethically. That’s your edge.

For Working Professionals

The value of your role depends on your ability to work with intelligent systems. This means upskilling in areas like data literacy, cybersecurity awareness, and cross-functional collaboration. Finance professionals who understand how AI tools operate—without necessarily being coders—will remain relevant and in demand.

For the Next Generation

If you’re a student or just starting your career, don’t just learn finance. Learn how finance interacts with technology, ethics, and regulation. Develop hybrid skills—think product strategy, UX, or AI ethics. The future belongs to problem-solvers who can think beyond one field.

What’s Next?

As AI continues to shape fintech and banking, one truth stands out: humans aren’t being replaced—they’re being redefined. Roles will change, workflows will evolve, but the need for sharp thinking, creative strategy, and ethical decision-making is only growing.

Smart systems need smart people behind them. That’s where you come in.

Want to stay ahead of the curve? Whether you’re an entrepreneur, a working professional, or a student preparing for what’s next, we’re here to help. For deeper insights, custom strategies, or learning resources, could you email us for more details?

📅 Book a Discovery Call

If you’re tired of shipping slow, fixing broken endpoints, or guessing your backend structure — let’s talk.

📧 ask@thepythondevelopers.com We’ll help you scope, simplify, and scale.

Pune, India

Pune, India +91 8960790891

+91 8960790891 ask@thepythondevelopers.com

ask@thepythondevelopers.com